Walmart Brings BNPL to Self-Checkout in 4,500 Stores Via Expanded Partnership with Affirm

Retail TouchPoints

DECEMBER 20, 2023

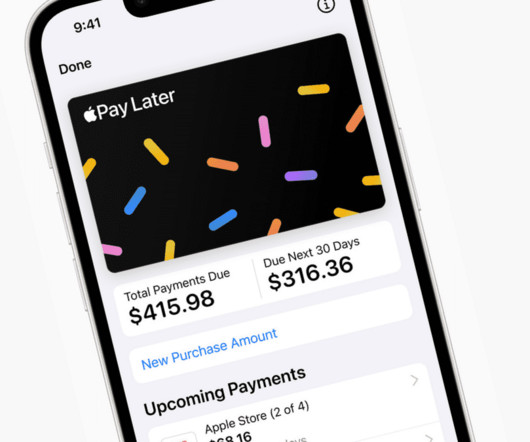

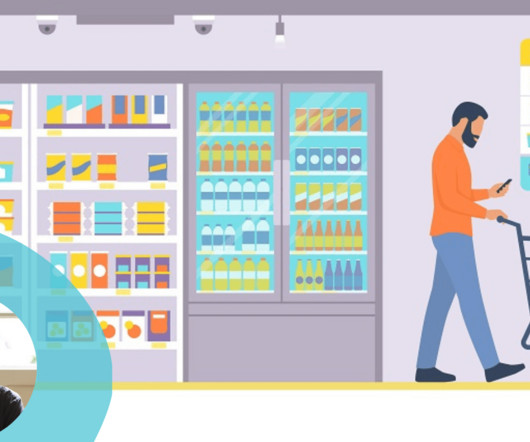

Walmart will offer buy now, pay later (BNPL) options at self-checkout kiosks in more than 4,500 U.S. Indeed, until recently most BNPL offerings were relegated to the digital realm, but stores are widely seen as the next big area of expansion for this increasingly popular financing option. year over year.

Let's personalize your content