Why Backend Orchestration is the True Payment Experience Unlock

Retail TouchPoints

JANUARY 26, 2024

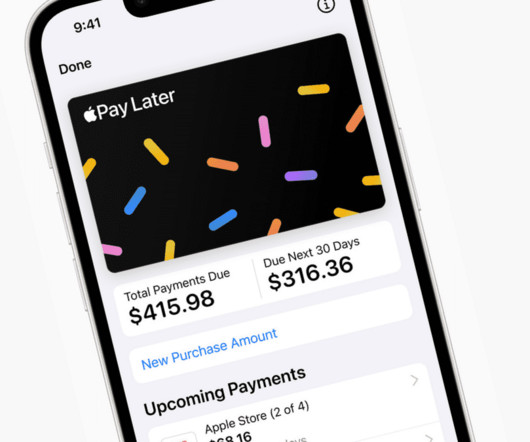

The seamless nature of digital commerce has inspired consumers to expect more from the payment experience everywhere they shop — online, in-store and even via social channels. Customers today expect to be able to shop where and when they want and use the payment method they want.” more compared to their previous buying levels.

Let's personalize your content