Banner Black Friday Sales Bode Well for Holiday Season

Retail TouchPoints

DECEMBER 2, 2024

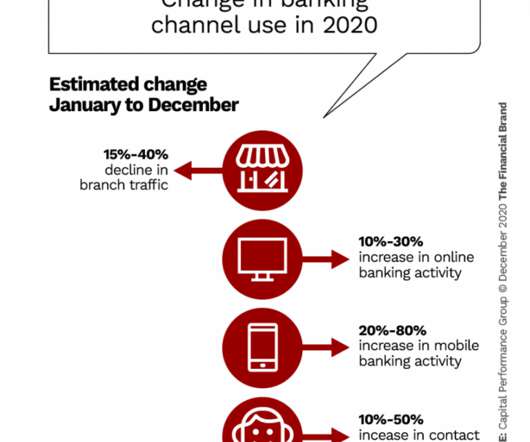

on Black Friday according to Mastercard SpendingPulse , which measures in-store and online retail sales across all payment types. That is more than double what consumers spent just a few years ago in 2017, when Black Friday drove a little over $5 billion in online spend. retail sales (excluding automotive) up 3.4%

Let's personalize your content