Top 5 Security Challenges for Buy Now Pay Later Apps

Retail TouchPoints

MAY 16, 2022

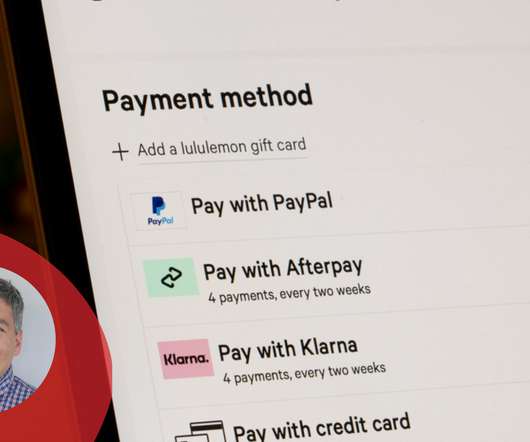

has grown by more than 300% per year since 2018, reaching 45 million active users in 2021. It’s clear this reverse layaway payment model is also here to stay. In BNPL, consumers receive the goods or services that they want to buy, but payment is staggered over monthly payments for a certain period of time with no interest.

Let's personalize your content