How Retailers Can Prevent Buy Now Pay Later Fraud

Independent Retailer

AUGUST 29, 2022

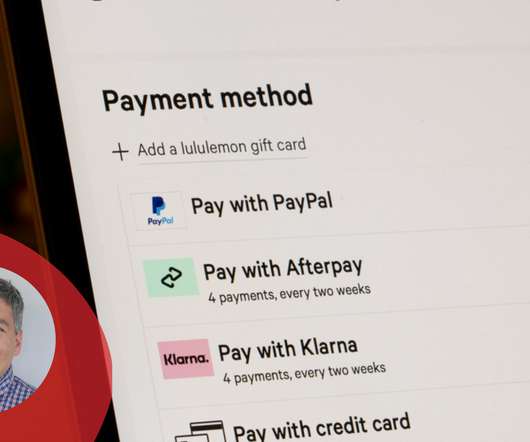

Current fraud controls such as IP and geolocation intelligence are very easy to spoof, and that is not enough to fight against BNPL fraud. ” Apple recently announced its big move into Buy Now, Pay Later (BNPL). “The ” Apple recently announced its big move into Buy Now, Pay Later (BNPL).

Let's personalize your content