Embedded Finance: Making Payments Possible in New Frontiers

Retail TouchPoints

MARCH 27, 2023

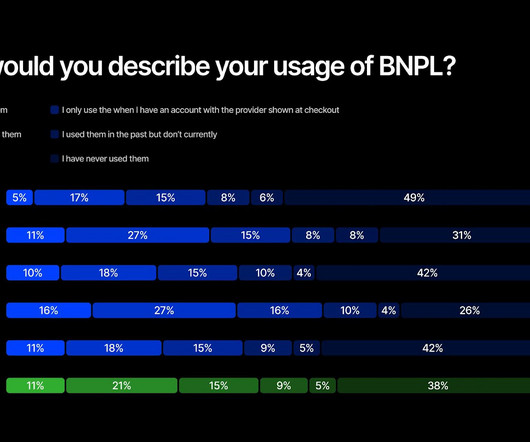

In fact, embedded finance will be a $777 billion opportunity by 2029. What’s really exciting about embedded finance is the simplicity of making complex payments accessible to a wide range of people and businesses, and the creative innovations that are opening new use cases and new opportunities. So how can businesses get a piece of it?

Let's personalize your content