‘Cash or Card?’: Why More Financing Choices Drive Consumers’ Decisions on Which Retailers to Shop

Retail TouchPoints

MARCH 4, 2024

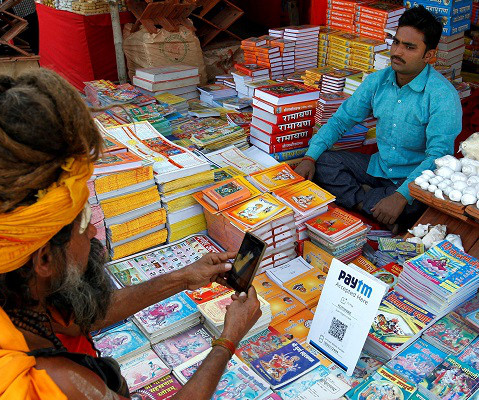

This includes enhancing in-store inventory, delivery services and even the personalization of customer service. However, when it’s time to check out, how do payment options factor into that customer experience? Is it Great Service or Great Financing Options? It goes without saying that great service is important.

Let's personalize your content