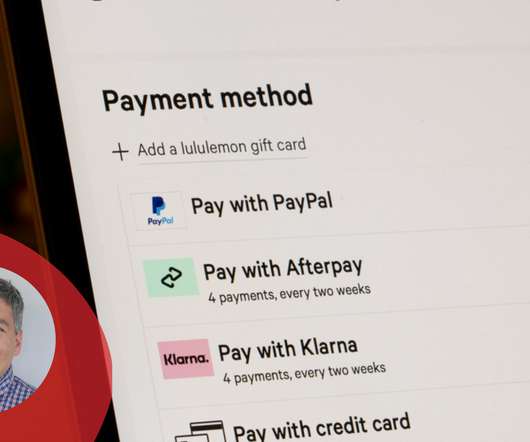

BNPL firm Pay It Later faces wind-up order, as SMEs claim bills unpaid

Inside Retail

APRIL 18, 2022

A group of small business owners have accused Australian buy now, pay later firm Pay It Later of withholding hundreds of thousands of dollars in sales revenue, drawing attention to the practices of smaller operators in the booming fintech sector. Founded in 2018, Pay It Later claims to have hundreds of retailers signed up to its service.

Let's personalize your content