From Obligation to Opportunity: Make Compliance Your Biggest USP

Retail TouchPoints

JULY 13, 2023

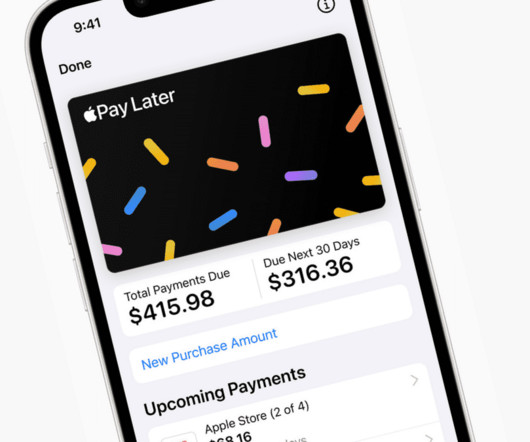

The challenging economic environment, intense regulatory pressure and ever-present threat of fraud are creating a perfect storm that’s sweeping across the global payments landscape. Instead of seeing compliance as a painful obligation, it’s time to see it as a springboard for innovation, expansion and collaboration.

Let's personalize your content