RBA to consider allowing merchants to pass on BNPL surcharges to customers

Inside Retail

JUNE 20, 2024

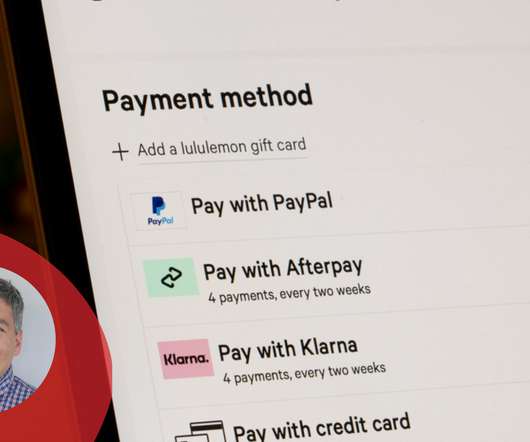

The Reserve Bank of Australia (RBA) says it will “revisit” the issue of surcharging in the buy now, pay later (BNPL) sector, flagging a new review to assess if payment sector reforms are necessary. The review will focus on surcharging, Connolly said, given the rapid development of payment systems available to merchants and consumers. “The

Let's personalize your content