Consumers and Merchants Should Look Before They Leap into BNPL Services

Retail TouchPoints

APRIL 27, 2021

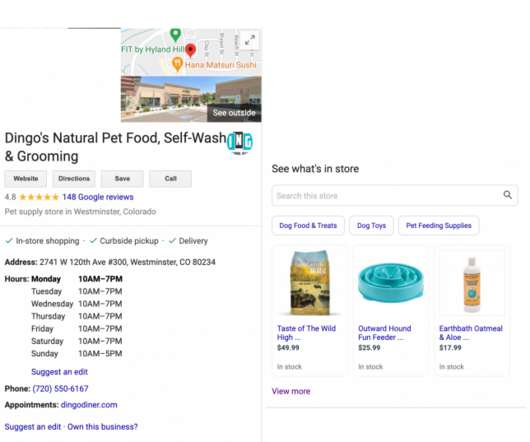

The economic fallout from the COVID-19 pandemic accelerated demand for buy now, pay later (BNPL) payment options. Surges in online shopping during the pandemic helped fuel the growth of point-of-sale loans — a market that is forecast to grow at an annualized 9.8% over the five years through 2024-25, to $1.1

Let's personalize your content