JD.com's Strategy, 10 Things to Know

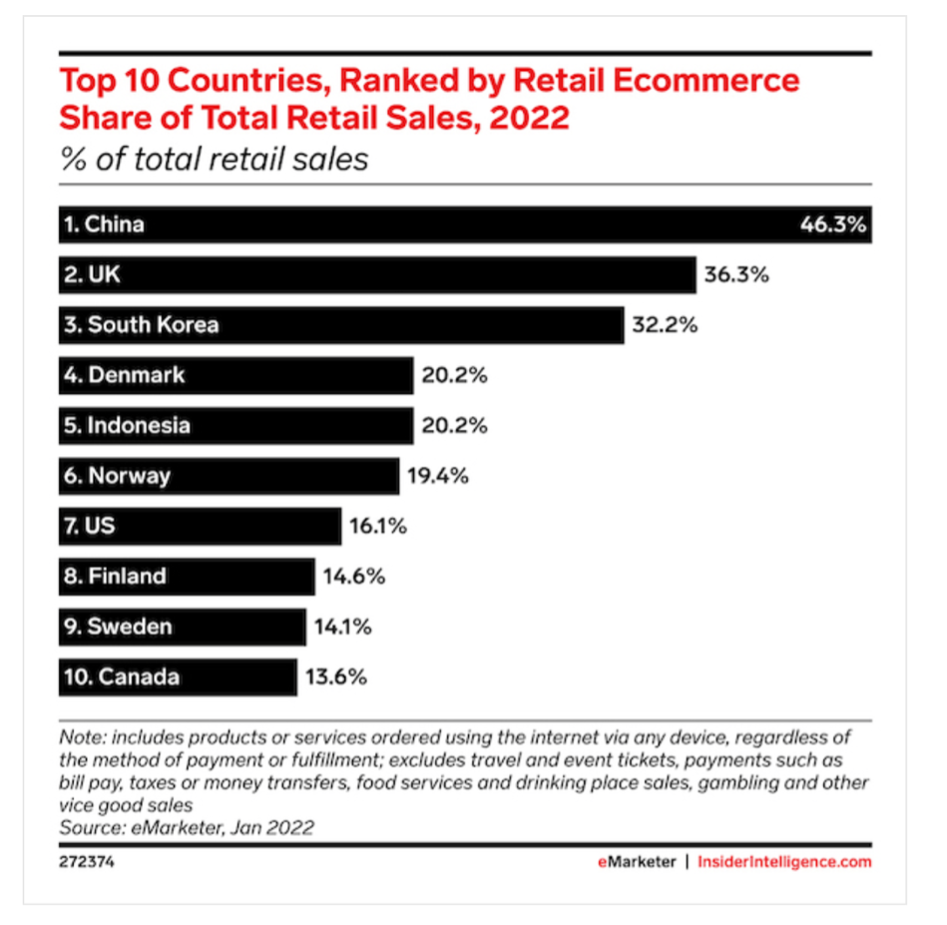

When you think of eCommerce and innovation perhaps Amazon is top of mind. But the truth is many eCommerce trends come from the largest eCommerce market in the world, China. Last year retail eCommerce sales in China came in at an eye popping $2.6 trillion giving China a 52% share of global eCommerce retail sales. For context, the United States has the second highest share at 19%.

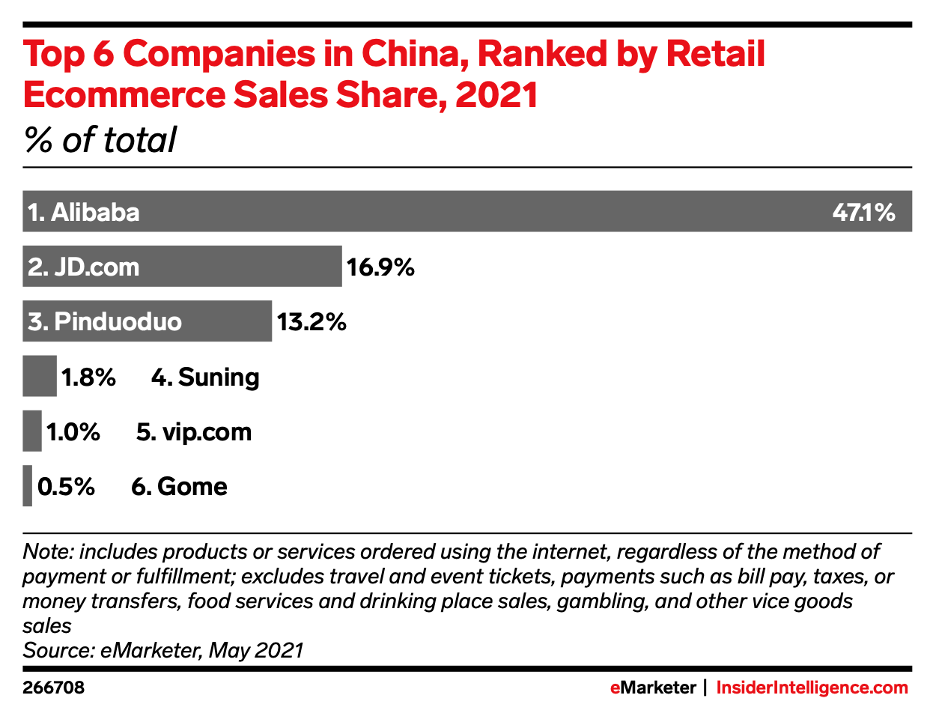

So which companies are driving growth and change in China? If you guessed Alibaba and JD.com you are right. JD.com is the second largest eCommerce retailer in China behind Alibaba.

In 2021 JD.com generated revenues of $149.3 billion up 28% over 2020. That’s an impressive growth rate, especially since it is off such a large base of sales. JD.com sells a range of products from electronics to food to apparel and has over 550 million active customers. If you are curious about what JD.com is doing to grow at such an impressive level then consider these 10 elements of its strategy.

1. Brick and mortar shopping isn’t dying. JD.com believes offline shopping plays an important role in its growth and success. With this in mind JD.com opened JD Mall last September in Xi’an China. The five story mall is home to more than 150 brands that sell a range of products including electronics, home appliances and furniture. People shopping in the mall simply need to scan a QR code attached an item they would like to buy and once they purchase it, selected items can be delivered to their home within as little as two hours. JD.com also offers after sale installation services on a 24-hour basis.

Not wanting anyone to be bored while shopping at JD Mall shoppers are provided with an immersive shopping experience including: “11 themed experience zones and 29 product interaction zones, such as a beauty salon, [an] audio experience area, drone testing, massage [area]…making it a multi-scenario and fun space for customers.” There are also virtual reality experiences customers can take part in. Part of JD.com’s rationale for opening a mall is to allow shoppers to experience products in a way they can’t online. This makes sense since more than 50% of retail sales in China still happen offline.

“JD is continuing to provide different kinds of physical stores amid the growing trend in which customers pursue a high quality and multi-store ecosystem, including JD E-Space, JD home appliance flagship stores, JD computer and digital stores and JD retail experience shops,” said JD.com in a press release.

2. A vast network of physical stores is key to success. JD.com is planning to have a network of 5 million physical stores. Speaking about this Xu Lei JD.com’s CEO said: we “can only service certain number of consumers. We want to apply our years of experience, including logistics, merchandising and technology to a much wider context.” “Therefore, last year [2019], we determined to position JD as an all-channel retail platform.” “In addition to our centralized online app, we also have a lot of de-centralized offline platforms. The offline market is very important to us.”

To reach its goal JD.com plans to partner with other retailers. “What’s more important is to make good use of our partner stores,” said Lei. “So far we have linked up with over 2-and-a-half million stores, including our own stores. In three years [by 2023], our projection is to have a network linking up to five million stores.”

3. Grocery is an important segment to grow. JD.com opened its own grocery chain called 7Fresh in 2018. As the name suggests these stores focus on selling high quality fresh foods. Shoppers who live within 30 km of a 7Fresh store can get their groceries delivered to them in as little as 30 minutes. By the end of last year JD.com had 49 of these stores. They are high tech stores where “if customers scan a QR code on some of the products including Chagan lake fish, imported milk and turbot, they can see all information [related to the product] from breeding to transportation,” says Helson Zheng head of 7 Fresh. That information also pops up on digital “magic mirrors” that are suspended over the produce department.

JD.com isn’t the only eCommerce retailer to go into the grocery sector. Both Alibaba and Amazon have grocery stores. Selling groceries generate frequent and repeat business and are one of the keys to the success of retailers like Walmart.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Omni-channel retailing is alive and well in China. “While online shopping definitely accelerated in 2020, saying physical retail is more or less obsolete is not true,” said Nishtha Mehta, a China-based corporate innovation coach. “In fact, we saw the acceleration of offline retail as well—there’s more of a shift toward a true omnichannel integration.”

“Consumers are now seeking faster and more convenient ways to shop and dine, be it pickup, delivery, or automated stores,” said Mehta. This is a trend playing out not only in China about in North America. With curbside and in-store pick up taking off during the pandemic and continuing to be popular even as COVID-19 health restrictions have eased in North America retailers are working hard to allow their customers to receive their purchases when and how they want to.

5. First party sales are one of the keys to JD.com’s success. JD.com has a large first party business where it houses its own inventory then delivers orders to customers through its own logistics network. This is in contrast to Alibaba which has a large third party business. Within a third party structure, the owner of the eCommerce platform, whether it’s Alibaba or Amazon does not own the inventory customers wish to buy but instead third party sellers are charged a fee to sell on the platform.

Some of the reasons why JD.com decided to focus on building a first party business was to improve the quality of goods on its platform, reduce the amount of counterfeit merchandise and ensure more reliable and fast shipping. JD.com has over 1,300 warehouses across China covering 23 million square feet of space and has over 200,000 delivery drivers. In recent years JD.com has focused on adding more third party sellers to its platform which has helped to improve margins.

6. Fast shipping is the way to go. JD.Com is focused on the fast delivery of goods. More than a decade ago in 2010 JD.com started offering same day and next day delivery and it claimed it was the first eCommerce company in the world to do so. By contrast Amazon started offering same day Prime delivery in 2019.

In 2020 90% of JD.com orders were delivered either on the same day the customer made its order or the next day. In 2020 JD.com started offering even faster one hour delivery called Instant Delivery.

7. Invest in emerging trends to keep the competition at bay. In recent years community buying has become increasingly popular in China. The community buying model, popularized by online retailers like Pinduoduo, allows a pool of shoppers to buy goods in bulk at lower prices than what they would pay if they bought the same goods individually. It’s a model reminiscent of Groupon and it has taken off in China.

Pinduoduo, for example, grew from zero to over 800 million users in only six years. With this segment of eCommerce growing quickly JD.com wants a piece of the pie. To this end last year JD.com invested $700 million in Xingsheng Preference, a community group buying start-up. JD.com also has a community group buying app on WeChat. It is estimated that the community buying market was worth $36.9 billion in 2020.

8. Markets outside of China are growth opportunities. JD.com opened its first brick and mortar stores in Europe earlier this year. The two stores named Ochama which are located in the Netherlands are automated stores manned by robots. They sell a range of goods from food to beauty to home furnishings. After placing an order on the store's app your order is picked and packed by robots. Once you arrive at the store to pick up your order all you have to do is scan a barcode to receive it from a conveyor belt. Customers can also have their goods delivered to their home.

The name Ochama is a combination of the words “omni-channel” and “amazing.” “With rich experience in retail and cutting-edge logistics technologies that the company has accumulated over the years, we aspire to create an unprecedented shopping format for customers in Europe with better price and service,” said Pass Lei, general manager of Ochama, JD Worldwide.

9. Loyalty programs hold immense value. Like Amazon which has Prime JD.com has a membership program called JD PLUS with over 25 million members. Members get free shipping, discounts and the ability to accumulate points. Average revenue per user is nine times higher for JD PLUS members than non members. It is the largest paid loyalty program in China from an eCommerce company. As Amazon has learned with Prime, programs like these are a great way to attract and retain customers.

10. Third party sellers are also part of eCommerce success. In recent years JD.com has increased the number of third-party sellers on its platform which has helped to strengthen its margins. Amazon has taken a similar approach with third party sellers generating 60% of its retail sales.