GameStop’s Strategy, What You Need to Know

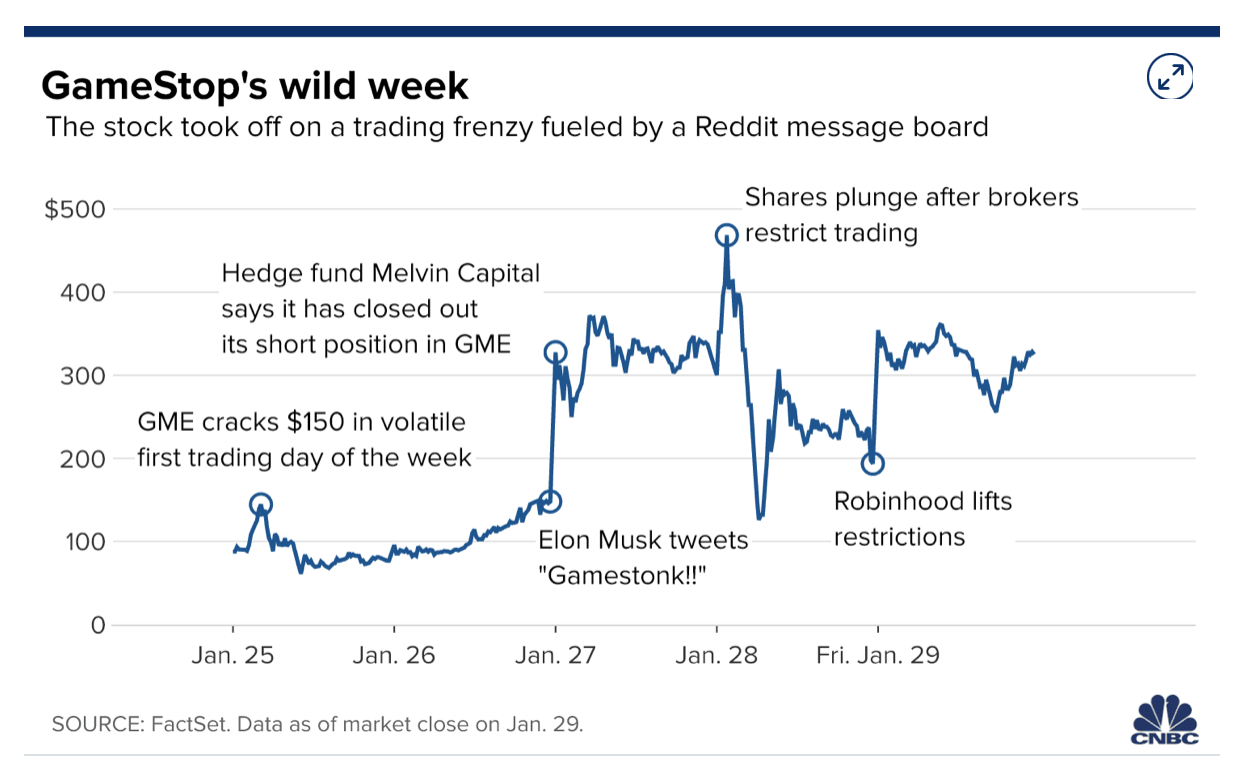

There aren’t many companies that have been discussed more over the past two years than GameStop. The video game retailer became a social media obsession when a group of day traders bid GameStop’s price up early last year trying to make a profit while sticking it to short sellers who were betting GameStop’s stock price would fall.

To get a sense of why this was a big deal, consider this, in January of 2021 GameStop’s stock was up an eye watering 1,625% and between December 31st, 2000 and the end of January 2021 GameStop’s market valuation increased from $1.3 billion to $21 billion.

Source: CNBC

But an important question remains, does GameStop have the fundamentals to justify its current $12 billion market valuation? It’s stock price is down from historic highs but hasn’t quite bottomed out. If you own an Xbox or a Playstation you can just download games from the comfort of your home you don’t even have to go to a GameStop store anymore. This is also a better path for video game publishers who make higher margins on downloads. GameStop’s revenues reflect this shift with sales peaking in 2011 at $9.6 billion, much higher than the $6.0 billion GrameStock brought in last year. If you are curious about whether GameStop is worth the hype then consider these four elements of its strategy.

1. eCommerce. GameStop is trying to move away from its roots in brick-and-mortar sales and towards generating more of its revenue from eCommerce. To facilitate this shift GameStop has hired several executives from Amazon including: Matt Furlong as CEO, now departed CFO Michael Recupero, Elliot Wilke as Chief Growth Officer and Jenna Owens as COO. The chairman of GameStop’s board is Ryan Cohen, co-founder of chewy.com. Cohen has said GameStop will have: “competitive pricing, broad gaming selection, fast shipping and a truly high-touch experience that excites and delights customers.”

In addition to adding new talent, last year GameStop announced it is opening new fulfillment centres in Nevada and Pennsylvania to have more inventory available to fulfill online orders as well as to get merchandise to customers faster. GameStop is hoping it can compete better with the likes of Amazon and Best Buy. In an SEC filing from last December GameStop said this about its strategy: "GameStop has two long-term goals: delighting customers and delivering value for stockholders. We are evolving from a video game retailer to a technology company that connects customers with games, entertainment and a wide assortment of products."

GameStop has even called itself “the Amazon of gaming.” But nearly 90% of new games played on consoles are only available by downloading the games. “I don’t know what they’ll do,” says Gary Kusin, a cofounder of one of GameStop’s predecessor companies. “But they won’t do it with video games. That train has left the station.”

2. Product expansion. One of the tactics GameStop is using to boost sales growth is to increase the depth of its product portfolio. "Increasing the size of our addressable market by growing our product catalog across consumer electronics, collectibles, toys, and other categories that represent natural extensions of our business,” wrote GameStop in an SEC filing is part of its strategy. GameStop is also focusing on new categories like chairs for games and live-stream equipment. But as GameStop moves into these areas it faces steep competition from the likes of Best Buy, Walmart and Amazon who are all among the top ten eCommerce retailers in the United States.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Cryptocurrency. Last year GameStop announced it is creating a marketplace for NFTs as well as a cryptocurrency wallet. GameStop sees this as a key part of its turnaround efforts and believes it will be able to gain market share since gamers have a high level of interest in digital assets. "We see significant long-term potential in the more than $40 billion market for nonfungible tokens (NFTs),” said Furlong. “In keeping with our focus on the customer, we are going to continue taking steps to create new offerings and make targeted bets in blockchain gaming and cryptocurrency."

Then earlier this year GameStop kept true to its promise and launched an NFT marketplace as well as a digital asset wallet. The wallet enables customers to sell, buy and trade digital assets. But this move has been met with skepticism since the buzz surrounding NFTs has died down. OpenSea, the world’s largest marketplace for NFTs, reported a sales decline of 70% in June of this year versus May of 2022 amidst a significant downturn in the market for cryptocurrency.

“It’s hard to see much of [a] future for the company given the huge secular shift in its core end market,” said Vital Knowledge analyst Adam Crisafulli. “And while gimmicks like an NFT marketplace may help attract interest in the stock, it’s unlikely to translate into a huge financial benefit.” Echoing this sentiment Wedbush Securities analyst Michael Pachter called GameStop’s move into the NFT market "nonsense," and said that it will "have no NFTs for sale and no customers, and wallets they are providing will be empty."

4. Other initiatives. In an SEC filing GameStop also said it is focusing on:

“Building a superior customer experience, including by establishing a U.S.-based customer care operation.”

“Strengthening technology capabilities, including by investing in new systems, modernized e-commerce assets and an expanded, experienced talent base."

Then earlier this year Furlong updated analysts on GameStop’s progress. He said that “the first year of our transformation was about starting to turn GameStop into a customer-obsessed technology company, one that has wider offerings, more competitive pricing, faster shipping, stronger customer service, and an easier shopping experience."

Calling yourself a technology company is now a tried and true tactic used by companies who are struggling to grow and want to keep their stock price high. But if we look at history it is clear that transforming a company is exceptionally difficult, just ask Sears. If you were reading about GameStop but didn’t know the name of the company you might think you were reading about Blockbuster.

Many analysts are critical of GameStop because its turnaround plans don’t have any merit. “Yet again, management failed to provide clarity around a long-awaited digital transformation plan that has been hinted at in the past but has yet to crystallize,” said Pachter. When companies are light on details it is usually because they don’t know what to do. But if history is our teacher then GameStop has a difficult road ahead.

You may also like:

8 Reasons Why Blockbuster Failed & Filed for Bankruptcy

The Downfall of Sears, 5 Reasons Why it’s Struggling to Survive

Best Buy’s eCommerce Strategy, What You Need to Know

6 Reasons Walmart’s eCommerce Strategy is Winning

13 Facts You Need to Know About StockX, the Multi-Billion Dollar Resale Platform