Tesco’s Strategy for Gaining Market Share

By Tricia McKinnon

There has been no shortage of threats as well as opportunities in the grocery sector over the last two years. They say a crisis like the COVID-19 pandemic doesn’t make a person it simply reveals who they are. Tesco was put to the test once the pandemic hit and it revealed why Tesco is Britain’s largest retailer. Despite many challenges Tesco has weathered the storm with revenues up 7% last year to reach £53 billion.

Tesco’s success is not by accident it has a carefully crafted strategy that is keeping its competition in the cut throat grocery sector at bay. If you are curious about how Tesco is managing to stay on top then consider these five elements of its strategy.

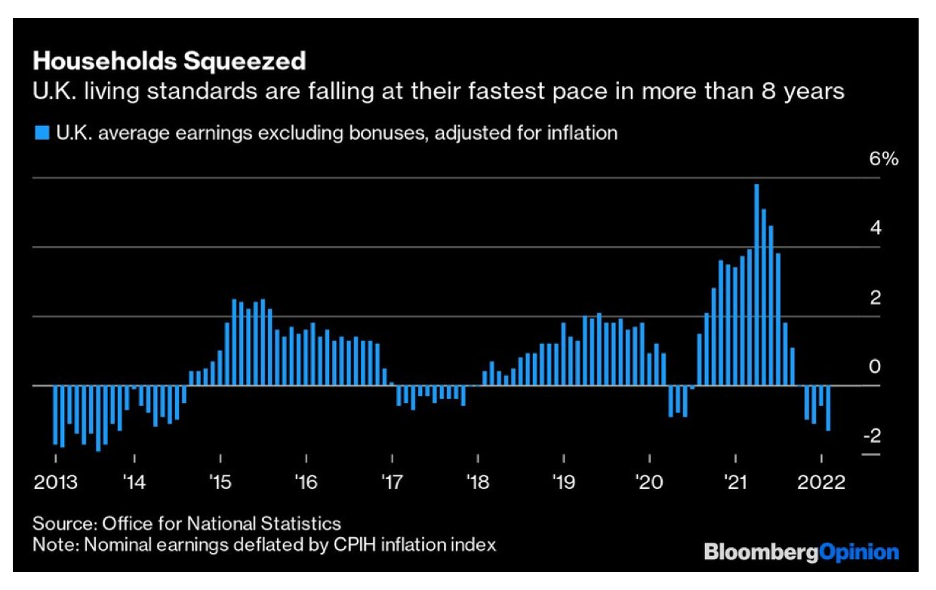

1. Value for money. Perhaps it can be taken for granted but most consumers are struggling to make ends meet.

Source: Bloomberg

That’s one of the reasons why discount grocers like Aldi and Lidl were able to gain share in the United Kingdom over a decade ago after the last recession. Consumers at that time were reeling from the recession and Aldi and Lidl entered the grocery market in the United Kingdom with low prices and were able to steal share. Tesco is determined not to have history repeat itself. It has attacked the threat from discount grocers head on by offering everyday low prices on a selection of items and it’s paying off.

“Customers want fantastically competitive prices on their everyday items and we address that through ‘Aldi Price Match’ and our ‘Low Everyday Prices’,” said Ken Murphy Tesco’s CEO. “That means they can securely and reliably shop us for everything at really great value, all the time.” The idea of focusing on value money is not new. Both Walmart and Amazon have used low prices to lure customers in for decades. If you aren’t charging low prices then you have to have a compelling reason to get traffic into your store otherwise consumers will seek out the cheapest alternative.

Tesco has everyday low prices on more than 1,600 items and has an “Aldi Price Match” policy where it matches Aldi’s prices on 650 items. That reduces the need to shop at discount grocers. Tesco even tried its hand at opening a discount grocery chain called Jack in 2018 but it closed the chain of 13 stores earlier this year. "We have learnt a huge amount from Jack's and this has helped Tesco become more competitive, more efficient and strengthened our value proposition, including through the launch of Aldi Price Match,” said Jason Tarry, the chief executive of Tesco’s UK and Irish business. "In turn, this has enabled us to consistently attract new customers to Tesco from our competitors over the last two years and we know they increasingly recognise the value they can find at Tesco.” "With the learnings from Jack's now applied, the time is right to focus on ensuring we continue to deliver the best possible value for customers in our core business."

2. Fast delivery. Shipping speeds are at the forefront of competition in the retail sector. A few years ago getting a package delivered in less than two days was seen as a major accomplishment now there are companies that can deliver in less than half an hour. With this in mind Tesco launched Whoosh last year with the promise to deliver groceries in 60 minutes or less. The service allows customers in selected markets to order from a selection of 1,700 products including fresh food, everyday and baby essentials and household products,

Murphy has said that he’s not quite sure how Tesco is going to make rapid delivery profitable but that “we do think it’s somewhere we need to be in. We need to have a good quality proposition that fits into our overall proposition. So it fulfils our strategic desire to make sure our customers can shop with us wherever, whenever and however they want.”

Tesco did not stop there it is also partnering with Uber Eats as well as Gorillas to offer fast delivery. Gorillas can deliver orders in as little as 10 minutes from a range of 2,000 convenience related items which means if you are looking for an afternoon snack you don’t have to wait to get it. Gorillas is picking merchandise from mini warehouses located in Tesco stores. “Through our partnership with Gorillas, we can be even more convenient to our customers, helping them with last-minute Tesco products delivered in minutes,” said Tom Hebbert, group innovation director at Tesco. “Customers have responded really well to the first two sites in Thornton Heath and Lewisham and we look forward to bringing this service to our customers in Manchester.”

“The idea that we can reach our customers in just 10 minutes is really exciting. We are committed to being easily the most convenient choice for our customers, enabling them to shop whenever and however they want,” said Tarry.

3. Loyalty program. Remember the days when you never thought about the boring old loyalty program you signed up for? Then Amazon Prime changed the game. What was once a nice to have is now a must have for many retailers. Tesco’s Clubcard has been around for a long time, since 1995. Even back then Tesco saw the importance of gathering customer data through a loyalty program and using that data to better understand its customers.

Tesco uses its loyalty program to offer discounts to its 20 million members. For example, last year between October and December Tesco offered 50% off discounts to Clubcard members. Those promotions were so compelling Tesco added 1.9 million new app users over that three month period. Out of all of Tesco’s promotions 95% are linked to its Clubcard making it easy to see why Tesco has been able to amass millions of members. Tesco’s Clubcard also makes up 80% of Tesco’s transactions "Crucially compared to many other loyalty schemes it's really easy for shoppers," said Fraser McKevitt, Kantar's head of retail and consumer insight. "You don't have to do anything, you get the great price just by turning up with your Clubcard."

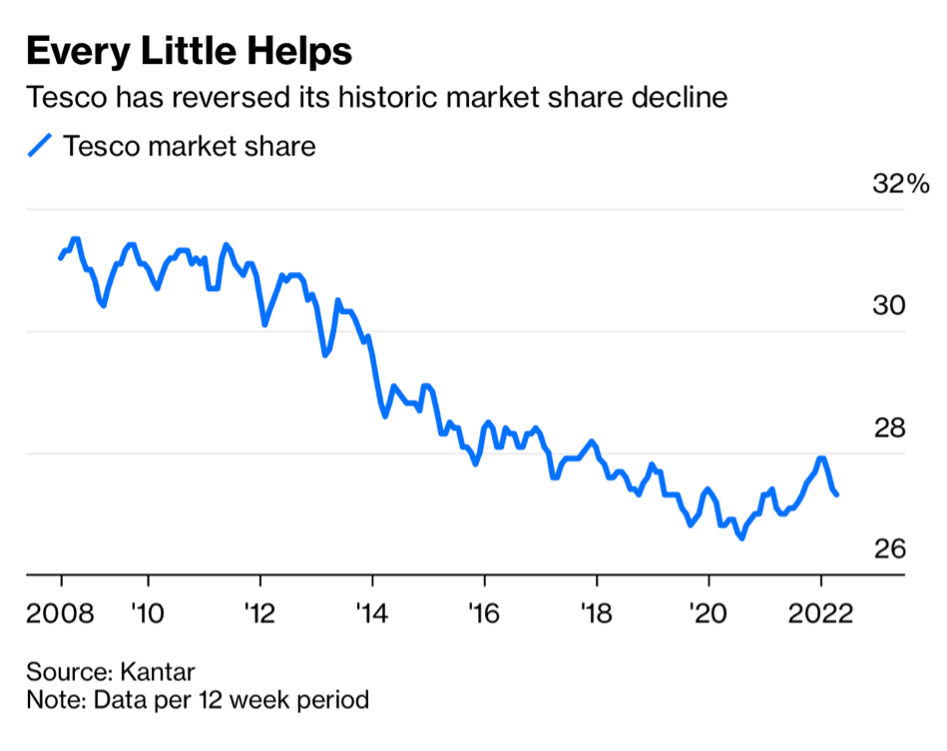

Having an effective loyalty program as well as the right value proposition has helped Tesco to regain market share in the competitive grocery market in the United Kingdom.

Source: Bloomberg

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Tech enabled stores. Last year Tesco opened its GetGo store concept in High Holborn London. This store allows customers to walk out with their groceries without having to scan any items or go through a checkout. This store uses "a combination of cameras and weight sensors” to detect what customers have purchased. Then customers are charged for their groceries through Tesco’s app.

With six stores in London utilizing Amazon’s “just walk out technology” Tesco is trying to keep up with the competition. "Our latest innovation offers a seamless checkout for customers on the go, helping them to save a bit more time,” said Kevin Tindall, managing director of Tesco Convenience." “This is currently just a one-store trial, but we're looking forward to seeing how our customers respond."

Several other retailers in the United Kingdom are testing a similar format including Sainsbury, Aldi, and Wm Morrison Supermarkets.

5. Retail media. Amazon continues to show retailers how to make money. For many years one of Amazon’s worst kept secrets was its burgeoning media business. But that business got so large that for the first time earlier this year Amazon announced how much money it makes by selling advertising and it’s a lot. In 2021 Amazon made $31 billion in advertising sales, enough to give Amazon the third largest digital advertising business in the world behind Facebook and Google. Amazon makes more in advertising in a year than many retailers make combined.

Now that Amazon has proven that retailers have lucrative online traffic retailers from Tesco to Target have jumped on the advertising bandwagon. Tesco sees advertising as way to boost its revenues. “We do think it could be a significant contributor over time,” says Murphy. To entice advertisers to advertise on Tesco’s digital properties Tesco is flouting its Clubcard data from 20 million members, shopper data from its stores and the popularity of its website which has 65 million visitors each month.