4 Things to Know about Instacart’s Strategy

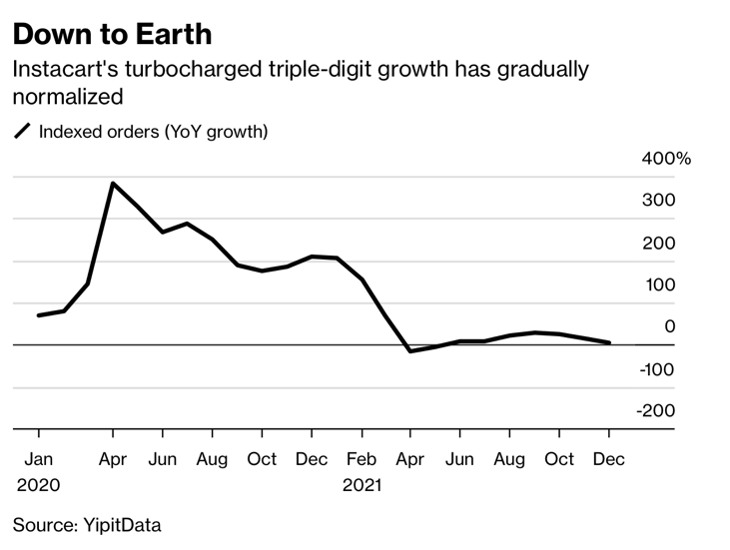

Heading into 2020 there was no way Instacart could have foreseen what was up ahead. The COVID-19 pandemic made food delivery companies like Instacart grow at rates they couldn’t have imagined. With consumers afraid and taking cover at home people began ordering groceries online at rates Instacart had never seen before. This change in behaviour caused Instacart’s revenues to jump by 330% in 2020.

But as health restrictions enacted during the pandemic eased consumers started eating out and shopping in-stores again causing Instacart’s fire cracker growth in 2020 to look like a distant memory as Instacart’s sales growth slowed to 20% in 2021 to reach $1.8 billion.

Source: Bloomberg

Like Zoom and Peloton and other pandemic success stories that are struggling as consumers return to their pre-pandemic behaviour there are concerns about Instacart’s future. Instacart even entered into discussions with Uber and DoorDash last year about whether they were interested in acquiring Instacart. But those talks fell through. With the climate for food delivery companies looking less desirable in March Instacart reduced its valuation by nearly 40% from $39 billion to $24 billion.

“Investors are going to be focused on growth, whether it’s bookings or revenue, and signs that they can continue to grow that number,” said Bobby Mollins, an analyst at Gordon Haskett Research Advisors. “They need to show how they plan to stay relevant.” Echoing this sentiment James McCann, CEO of Food Retail Ventures said “growth rates have normalized. Now, everybody is trying to figure out—where does this go? How do we do it profitably?”

As Instacart plans to go public here is the strategy it is banking on for success.

1. Advertising. If you have noticed there are more ads when you are shopping online then you aren’t imagining things. Retailers who generate a lot of online traffic have realized they can monetize those visits. Unsurprisingly Amazon was first out of the gate among retailers to realize it could make significant money from charging brands to appear at the top of search results as well as throughout the search page as you spend your time scrolling. A decade ago Amazon began to allow ads on its website properties and now it’s a huge business for Amazon bringing in $31 billion in 2021. Amazon now has the third largest digital marketing business in the United States behind Google and Facebook.

As Amazon built its advertising business other retailers took notice. Many retailers including Walmart, Target and Kroger see advertising as a new, lucrative and more profitable revenue stream. Not wanting to be left out of the mix Instacart is also focusing on building its own advertising business. Think about each time you are in Instacart’s app and are shopping for groceries for the week. Each page you look at presents an opportunity for a brand to advertise its products to you and for Instacart to make money off of those ads.

To build out this business Instacart is taking cues from the best in the business. Last year Instacart appointed Fidji Simo who was the former head of the Facebook app as CEO of Instacart. “Based on their current hires from, many from Facebook, I think that for them it seems as though the best revenue-driving investment in the near and potentially long term is investing in the media network” said Anne Mezzenga, a Target veteran and co-CEO of retail blog Omni Talk.

Instacart has also said that advertising revenues could be used to subsidize delivery costs both for consumers and its retail partners.

2. Fast delivery. Don’t you feel slightly impatient after you order something online and then have to wait several days to receive it? With consumers becoming increasingly impatient with delivery times retailers are always looking for ways to get your online orders to you as fast as possible. To provide a solution to this problem a number of “ultra-fast” delivery companies have popped up including Go Puff and Gorillas.

These companies promise to deliver goods, often convenience items like snacks, to customers in as little as 15 minutes. That is much faster than the same day or next day delivery offered by many grocery stores. Seeing these “ultra-fast” delivery companies as a threat, Instacart launched a new 15 minute delivery service in select markets earlier this year. Publix is one of the first retailers offering this the service. “With today’s Miami launch, Publix is bringing 15-minute delivery to their customers for the first time,” said Daniel Danker, vice president of product at Instacart. “Whether it’s a last-minute dinner ingredient or parents needing a quick restock on diapers, we know Miamians seek convenience in their lives and we’re excited to collaborate with Publix to power it.”

“Together, the two companies have developed a custom model for 15-minute delivery using Carrot Warehouses, an Instacart fulfillment solution offered as a part of Instacart Platform. This model allows Publix to offer thousands of items delivered from nano-fulfillment centers – including fresh produce, dairy, meat, and more – a broader selection than the industry standard for 15-minute delivery, ensuring items are in stock nearly 100 percent of the time,” said Instacart in a statement.

While customers will love having faster delivery many wonder how a service like this will make money. Two ultra-fast delivery companies, Fridge No More and Buyk recently shut down. Many say ultra-fast delivery companies would not exist if it were not for venture capital. The same is also said about food delivery companies in general.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Expansion outside of food. While Instacart may have started off delivering groceries, it has expanded into new categories. It has delivery partnerships with several retailers including Best Buy, Dick’s Sporting Goods, Big Lots, Walgreens and Sephora. It is also delivering non food items like prescriptions and alcohol. “We’re proud to partner with Best Buy, the largest consumer electronics retailer in the U.S., to offer customers across the country a new way to get the technology products they need delivered same-day. Whether it’s a new computer monitor for a home office, a smartwatch to track activity or a new slow cooker for the kitchen, we want to provide more ways for people to get the goods they need as quickly and safely as possible,” said Chris Rogers, vice president of retail at Instacart.

Partnering with Instacart is a faster way for retailers like Best Buy to get merchandise to their customers than using the services of FedEx, UPS or USPS. Expanding into new categories will also help Instacart to make up for slumping demand in its food delivery businesses as consumers continue to eat out more as restrictions from the COVID-19 pandemic ease. DoorDash has also followed a similar path, partnering with retailers outside of the food sector and calling itself a “last-mile logistics platform,” denoting it isn’t solely focused food.

4. Services. Earlier this year Instacart launched Instacart Platform which offers retailers several tools and solutions including warehousing, advertising technology and data analytics. Instacart will continue to help retailers to build and manage online stores and its partnership with Publix to offer 15 minute delivery is an example of Instacart’s new warehousing solution.

Instacart’s advertising technology will help retailers to set up their own ad business and revenue sharing model and is now being piloted at several retailers including Schnuck Markets Inc., Good Food Holdings and Plum Market. With these services Instacart aspires to become the “antidote to Amazon for grocers.” “When I came in, I really wanted to bring a much more ambitious vision: to really power every grocery transaction and to build the technology for all retailers to better compete with Amazon,” said Simo.

Like most companies that offer software as a service Instacart’s hope is to build a reoccurring revenue stream and in Instacart’s case one that has higher profit margins than its core delivery business. This makes sense since food delivery companies struggle with profitability. In a particularly revealing shareholder’s letter in October of 2019 GrubHub, a meal delivery company, wrote: “we didn’t then, and still don't believe now, that a company can generate significant profits on just the logistics component of the business. It is a commodity and there are significant variable costs that are hard to leverage even with technology and scale.” “Bottom line is that you need to pay someone enough money to drive to the restaurant, pick up food and drive it to a diner. That takes time and drivers need to be appropriately paid for their time or they will find another opportunity.”

Since the food delivery industry faces high levels of competition Instacart is looking to diversify its business so it can continue to grow even as people eat more outside of their homes and as competitors try to take share. “I think that what Instacart is doing is saying, ’We know that this relationship [with grocers] is going to continue to get pretty contentious. How do we continue to position ourselves as: we’re white-label. We’re trying to help you solve problems,” said Mezzenga.

Echoing this sentiment, Neil Saunders, Managing Director of GlobalData said: “the big thing for Instacart is to prove that they have an actual strategy and be an integrated service provider for these retailers that actually works and is reliable.” But the criticism of Instacart Platform has already started with Burt Flickinger, a long-time industry consultant, saying he likens Instacart Platform to something “grown in a hothouse at Harvard or Stanford that really had no common-sense, commercial application for the common shopper or retailer.”