Embedded Finance: Making Payments Possible in New Frontiers

Retail TouchPoints

MARCH 27, 2023

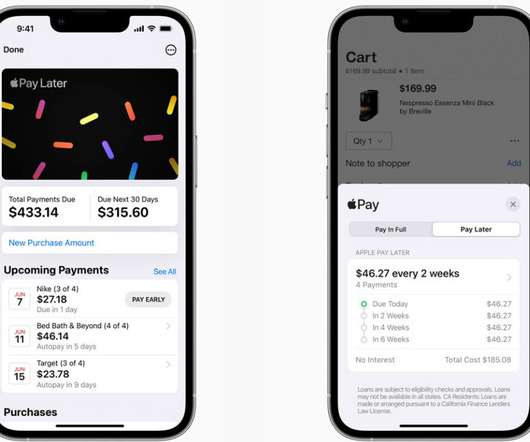

If we thought the pandemic-driven shift to digital payments was an evolution, we’re about to be catapulted into a new world, where payments will become possible in places thought impossible just a few years ago. Currently, consumer payments account for more than 60% of all embedded finance transactions and are set to reach $3.5

Let's personalize your content