Study: Consumers Warm to Social Commerce, But Payment Mistrust Could Hamper Growth

Retail TouchPoints

JUNE 7, 2021

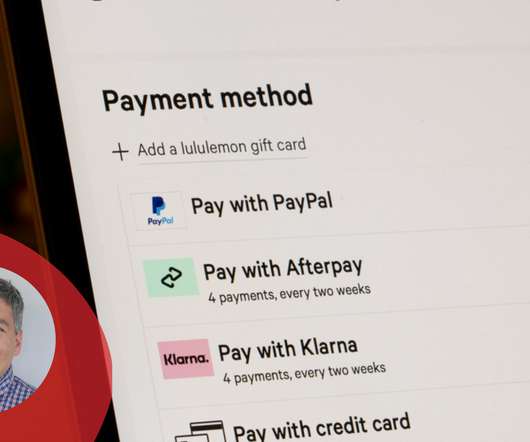

The increase in social media usage, combined with a tandem increase in online purchasing, proved to be the push both consumers and brands needed to move into the burgeoning realm of social commerce. Despite these efforts, 63% of purchases from social media were completed on an external site , according to the CouponFollow study.

Let's personalize your content