Why it’s a good idea to offer payment plans to your business customers

Inside Retail

NOVEMBER 15, 2021

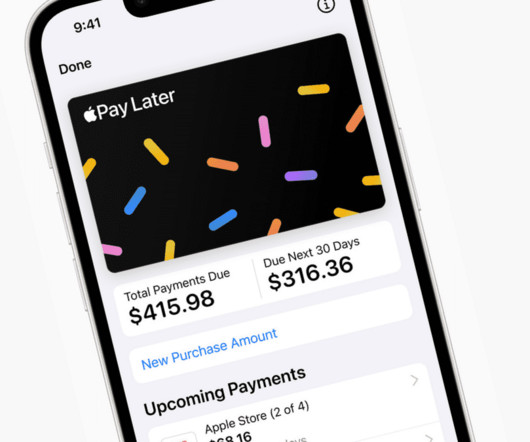

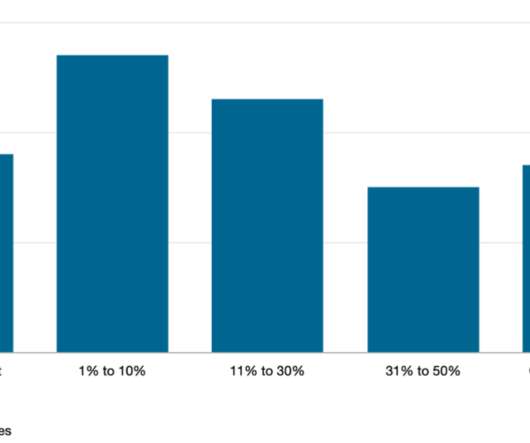

Payment flexibility has been commonplace in B2C transactions for many years, and now, emerging payment technology is making this possible for B2B trade. Why should your business provide payment plans to business customers? Utilising the power of automated technology to provide flexible B2B payment plans.

Let's personalize your content