Axerve white paper explores digital payments trends & the importance of multi-channel and hyper-personalised payments services

365 Retail

MAY 17, 2022

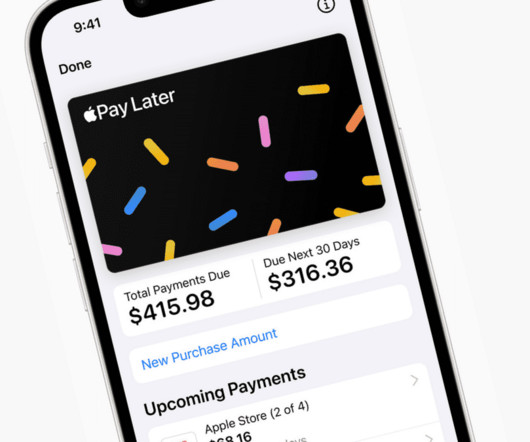

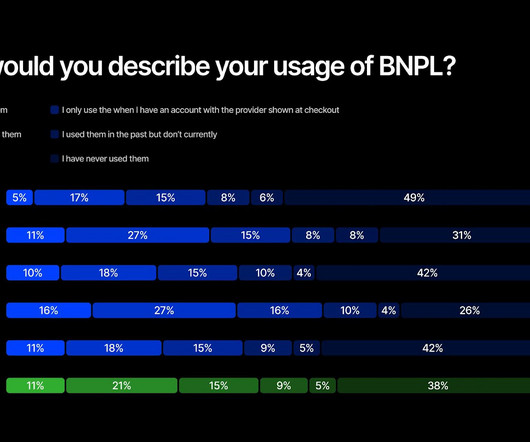

Axerve, Payment Partner to Grow, specialising in creating accessible and frictionless payment solutions for Ecommerce and physical sales, today announces the release of a new white paper, ‘ New technologies and trends in digital payments in 2022 ’. billion in fees, labour, and lost business in 2020.

Let's personalize your content