One of the most apparent impacts of the COVID-19 pandemic in the financial services sector is the expedited digitization of products and solutions. However, COVID-19 forced more than just accelerated projects. Businesses had to ensure they could deliver end-to-end service solely on their digital platforms without switching between digital and legacy channels. This drastic move to digital significantly increased the pressure to set up systems swiftly and effectively. While moving digitally, financial leaders in the financial services industry are also responding to the shift in customer expectations, growing regulatory requirements, such as the recent Royal Commission, and the modernization of backend processes.

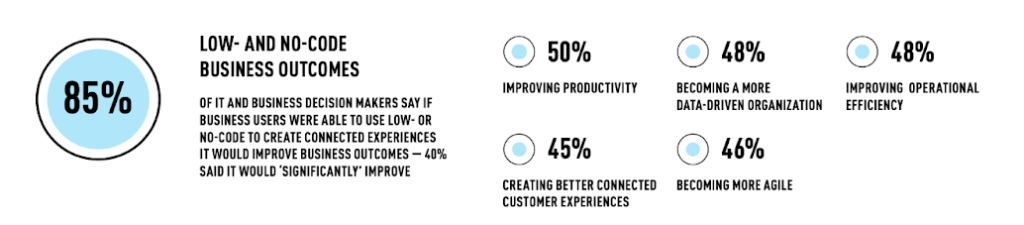

Our recent IT and Business Alignment Barometer report surveyed IT and business leaders worldwide to understand their priorities in the wake of the pandemic along with the challenges preventing them from meeting their goals. One of the most glaring takeaways from the report was that, while leaders understand the benefits of automation and integration initiatives, lingering concerns around data security and governance hold them back from taking action on these initiatives.

A deeper look at financial services

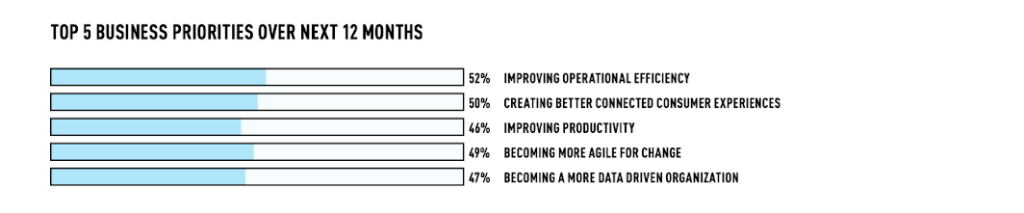

Out of the industry verticals we surveyed, we found that financial services best understood the power of automation and integration and had made the most progress on realigning their IT and business decision-making to improve collaboration amongst the two departments. Ninety-three percent of IT and business leaders in financial services agree that automation and integration are key for the future of their businesses. Similarly, 91% of retail executives also agree, which can be linked to the same accelerated shift to digital offerings and customer experience demands experienced in financial services in the wake of COVID-19 lockdowns. In fact, 50% of financial services IT decision makers list “creating better connected customer-experience” amongst their top 5 business priorities over the next 12 months.

However, we found that financial services are also the most susceptible to security and governance challenges. Eighty-nine percent of financial leaders were concerned that their integration initiatives were being held back, preventing non-technical users from integrating their data, highlighting the balancing act they face in modernizing their operations while remaining compliant.

Having perhaps borne the brunt of consumers’ changing habits towards online interactions over in-person in even the years leading up to the pandemic, the financial services industry has been slow to digitally transform. In recent years, we’ve seen the rise of neobanks occupying the digital spaces that were neglected by traditional financial institutions, who are now being forced to bring their customer experience in line with their more agile competitors.

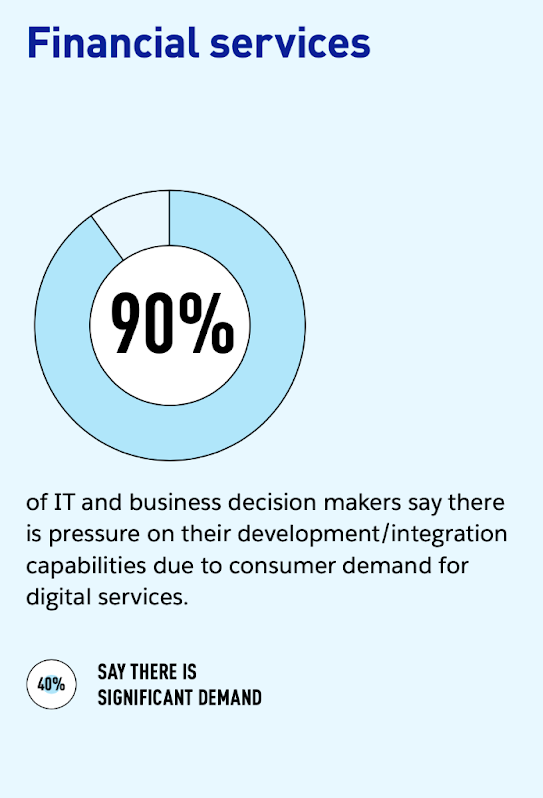

An increasingly digital world has impacted financial customers’ expectations of their financial services providers, and now the demand for digital and mobile platforms to deliver services to customers is no longer a nice-to-have, but a necessity. Half of the leaders we surveyed said increased demand for digital and mobile had put pressure on their development and integration capabilities, while 40% said that the pressure was significant.

The strength of digital customer service

To cater to their customer’s growing demands and shifting purchasing habits, financial service providers must lean into greater composability of their IT infrastructure to bring new digital and mobile services to market faster and to reduce development costs.

Investing in APIs to expose various data sources and digital assets can help financial institutions to build integrated experiences that cater to new and emerging requirements for customers. Financial services providers are responsible for differentiating themselves with personalization and nothing engages customers like fast and seamless interactions.

We’ve seen financial institutions already start implementing these sorts of personalized experiences with mobile applications. A robust mobile app allows customers to access critical banking services like loans and mortgages without the need for physical application processing and paperwork. By embedding the application with APIs, an organization can incorporate digital signature or document capture into their existing app, giving customers a much easier and faster way to access services.

Another simple addition to a financial services app is incorporating a video conferencing service like Zoom or Microsoft Teams using APIs to facilitate face-to-face interactions, albeit remotely. These may seem like a small feature, but when customers are feeling financially pressured, any positive differentiation of customer experience can go a long way in ensuring customers keep returning to you for their financial needs.

One fintech’s journey to automate and improve customer experience

Using APIs to transform its customer experience during the pandemic, Australian online home loan lender Tic:Toc eliminated the manual submission process when applying for a home loan, reducing the entire application process from weeks down to minutes. Rather than manually signing and sending through various application forms, the whole process is now digital and only requires 10 minutes of human effort from the beginning of the application to loan approval.

As we become more connected online, the importance of digital and mobile in financial services will only continue to grow. Customers will continue seeking out more accessible and seamless ways to procure financial services, so the onus is on these institutions themselves to cater to these needs. The only way they will do that is through the adoption of technology.

Learn more about Tic:Toc’s fully-automated home loan platform.

Getting started with APIs

Check out our recently-released MuleSoft Accelerator for Financial Services, which offers all the tools and documentation you’ll need to start developing APIs. Our Accelerator contains a collection of technical assets and documentation representing the best practice approach for financial services, helping you make implementations faster and easier.

Accelerators are designed as modular building blocks that customers can customize themselves, saving hours on discovery, design, development, and testing whenever you use an asset from the accelerator.

Learn more about how APIs can transform your business by downloading the full IT and Business Alignment Barometer Report.