Supplier insight: heated tobacco

Kate O’Dowd, head of commercial planning, UK & Ireland, Philip Morris

“It is nearly seven years since IQOS first launched in the UK in 2016. As a new tobacco product, IQOS quickly established heated tobacco as a category acceptable to the adult consumer, with several indicators highlighting its potential in the market,” says Kate O’Dowd, head of commercial planning for the UK & Ireland at tobacco manufacturer Philip Morris Limited.

“IQOS is a viable alternative to cigarettes because it heats real tobacco for a more satisfying taste experience. That is why the majority of smokers who trial it switch away from smoking for good.

“It is more affordable [than traditional smoking], with 20 Heets sticks costing less than half the average price for a pack of 20 cigarettes. Customers also have access to 10 Heets variants – ranging from menthol to traditional tobacco blends – which means there is a variant to meet every consumer need.

“Steps such as these are vital, particularly when we consider that 45% of ex-adult smokers abandoned previous attempts at switching to alternatives due to the product not being right for them.

“And, while retailers can communicate the benefits of alternatives at the point of sale, it is the responsibility of manufacturers to meet customer demands and preferences through product innovation. This is perhaps why 62% of retailers believe manufacturers should focus on improving the acceptability of smoke-free products among adult smokers.”

Supplier insight: tobacco accessories

Gavin Anderson, sales and marketing director, Republic Technologies

“Tobacco accessories, including filters, papers and lighters, provide an important opportunity for retailers to benefit from impressive margins and incremental sales.

The right range of brands and effective POS gives retailers the potential to make sure their store stands out,” says Gavin Anderson, sales and marketing director at Republic Technologies. “Roll-your-own shoppers tend to be repeat purchasers, so having a good variety of products, with a fully-stocked display, will keep them coming back,” he says.

“At Republic Technologies, we work with retailers to highlight their best-selling product lines and newly developed products to help them drive impulse sales. Our compact displays can be of real benefit to retailers, as they grab shopper attention.

“Our iconic brands – including Swan, Zig-Zag and OCB – have considerable history in the market and are synonymous with quality and value for money. This, combined with our team’s valuable expertise in the category, means we are well placed to add real value for retailers.

“Rolling papers are the star performers in the category as the highest value sector within tobacco accessories. OCB from Republic Technologies is helping to drive this success as the UK’s fastest-growing mainstream paper brand, making it a must stock for retailers,” Anderson adds.

“The ‘slim and tips’ sub-category is showing impressive year-on-year growth of 28.5% as we see an increasing move to premium paper and tips formats.

“This again highlights a big opportunity for retailers to tap into this growth with popular brands.”

Supplier insight: cigars

Alastair Williams, country director, Scandinavian Tobacco Group UK

“There is no doubting the importance of value as a consumer trend at the moment,” says Alastair Williams, country director for the UK at Scandinavian Tobacco Group. “Many consumers are going to be increasingly price-conscious as the cost-of-living crisis continues to bite, and this will affect cigars and wider tobacco category purchases just as much as any other category in-store. Retailers should ensure they are highlighting their value brands to customers to help them save money.

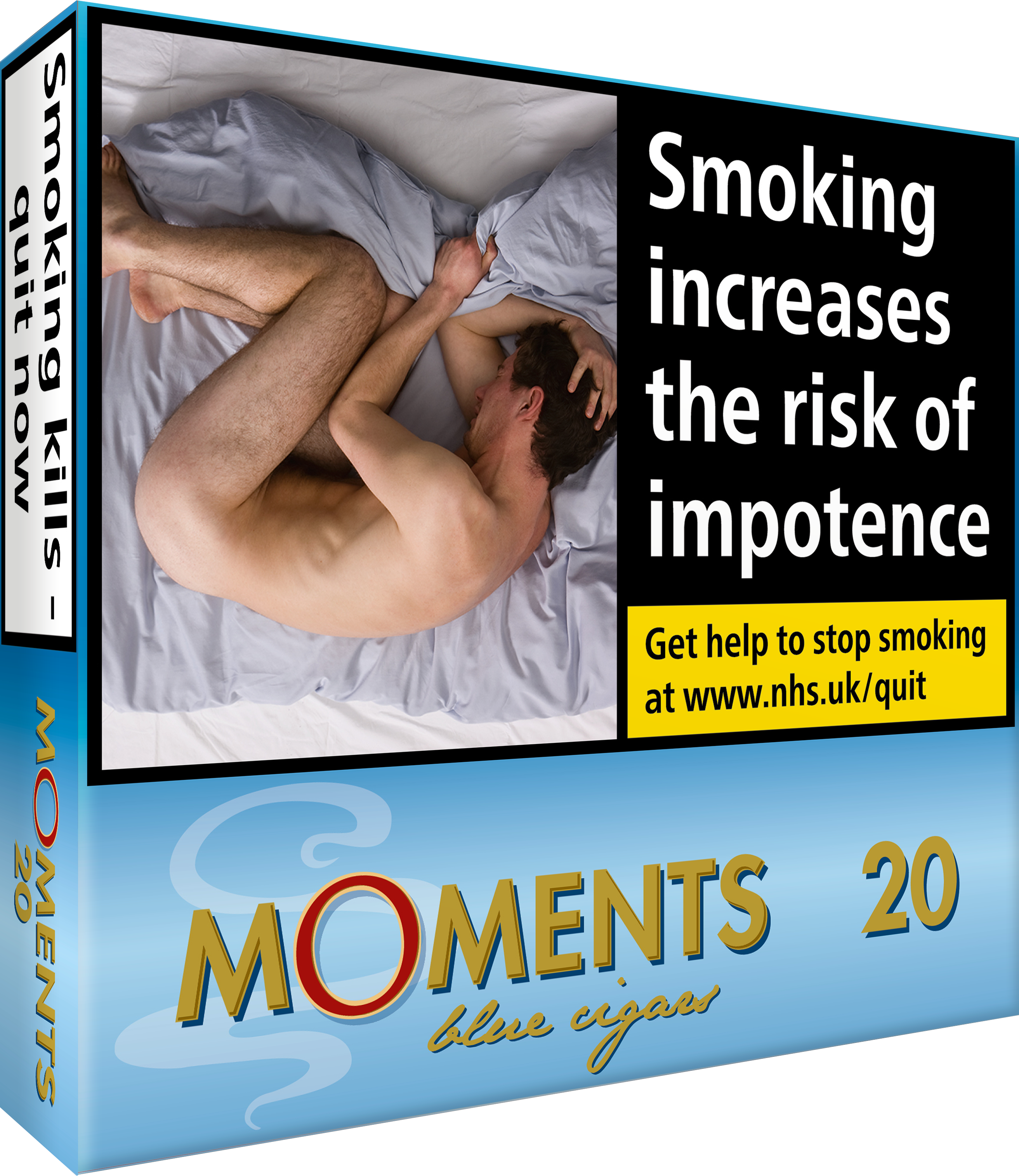

“Having said that, the search for value has been a trend in cigars for some time now, as evidenced by the success of our Moments Blue brand, which offers a quality smoke at a low price.

“It is now the sixth best-selling cigar brand in the UK in value terms, but interestingly most of its sales go through the multiple grocery channel, so I wonder if it is one area where independent retailers might be missing a trick by not stocking it.

“To boost cigar sales, it is important that retailers stock the right range rather than a big range, as the top 10 brands account for more than 90% of sales – so don’t tie up your cashflow with slow-moving brands. It is Miniatures that remain the engine room of the cigar category, so it is important to get this segment right.

“By far the biggest player here is our Signature range, which is ably supported by our Moments brand, which offers a good-quality smoke at a cheaper price.”

Supplier insight: value tobacco

Mark McGuinness, marketing director, JTI UK

“Now more than ever, value tobacco is a key trend.,” says Mark McGuinness, marketing director at manufacturer JTI UK. “In 2022, we launched two of our most iconic brands into the ultra-value segment to provide high-quality value for existing

“Now more than ever, value tobacco is a key trend.,” says Mark McGuinness, marketing director at manufacturer JTI UK. “In 2022, we launched two of our most iconic brands into the ultra-value segment to provide high-quality value for existing

smokers, featuring the lowest recommended retail prices from JTI, including Benson & Hedges Blue (a new rolling tobacco offering) and a new ready-made cigarettes range (Mayfair Silver).

“This is part of a long-term strategy for JTI. Over the last

two years, we have launched products that tap into this growing demand, from Sterling Rolling Tobacco Essential through to Benson & Hedges Blue Rolling and the new ready-made cigarettes range – Mayfair Silver.

By offering iconic brands such as Mayfair and Benson & Hedges at new ultra-low prices, retailers can capitalise on both products’ brand heritage, and also offer a competitive price.

Benson & Hedges Blue Rolling includes quality Virginia tobacco blend and 100 papers within the 30g and 50g pouches. Mayfair Silver is available in both king size and super king, across England, Wales and Northern Ireland. These products are now available across all channels.”

Supplier insight: vaping

Tom Gully, head of consumer marketing, Imperial Tobacco

“The number of vapers in the UK has grown by 3% over the last year to 3.6 million, so it is clear there will be continued demand from consumers for vaping products.

“The number of vapers in the UK has grown by 3% over the last year to 3.6 million, so it is clear there will be continued demand from consumers for vaping products.

To tap into this rising trend, retailers need to make sure they are dedicating sufficient space in-store for vaping products and stocking the right range for their customer base,” argues Tom Gully – head of consumer marketing for Imperial Tobacco.

“Recent data shows that both closed-pod systems and basic open-pod systems remain popular choices for vapers, accounting for 70% of the total UK vaping market size in 2022 – 35% for closed-pod systems versus 35% for open systems. We are also seeing significant growth in the disposables category, which is worth about £132m and makes up 10% of the market – up from 5% in 2021.

“Our recently announced Blu bar range comprises a quality collection of disposables and ready-to-use vape products with a compact pocket-size design that allows for the ultimate on-the-go convenience. Each Blu bar device contains 20mg of nicotine in 2ml of liquid, providing up to 600 puffs, and features an LED indicator that lights up when in use.

“Our recently announced Blu bar range comprises a quality collection of disposables and ready-to-use vape products with a compact pocket-size design that allows for the ultimate on-the-go convenience. Each Blu bar device contains 20mg of nicotine in 2ml of liquid, providing up to 600 puffs, and features an LED indicator that lights up when in use.

“Available to buy at an RRP of £5.99 per device, the new Blu bar range includes six flavours, carefully chosen due to their consumer appeal, including Kiwi Passionfruit, Mango Ice, Banana Ice, Peach Ice, Watermelon Ice and Strawberry Ice.”

Talking Retail Grocery and product news for independent retailers

Talking Retail Grocery and product news for independent retailers