Why DoorDash & Other Delivery Apps Struggle with Profitability

By Tricia McKinnon:

Let’s take a walk back in time. It’s 2019. You are hungry but you are too tired to make dinner. Without many options at home you simply head out of the door and grab a quick bite to eat at your favourite local restaurant. You never really think about ordering in because grabbing food yourself is so easy and you want to avoid those pesky delivery fees. Sound familiar? Fast forward and the world changes. The COVID-19 pandemic hits and suddenly ordering in sounds appealing.

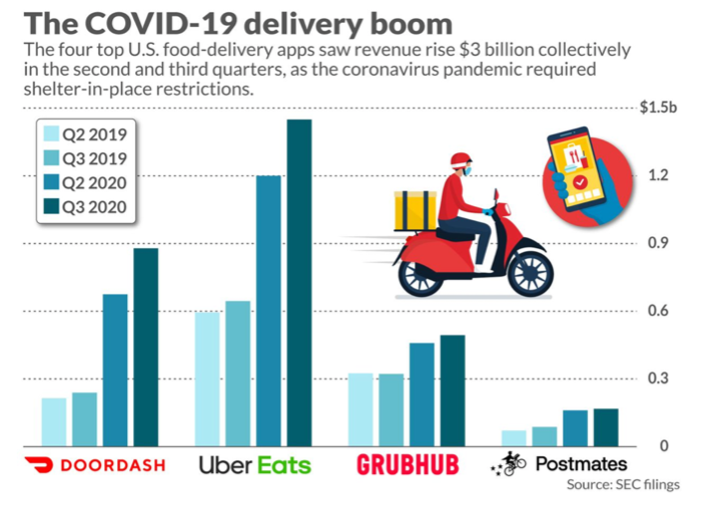

Food delivery companies like DoorDash and Uber Eats were clear beneficiaries of the public health crisis. Consumers around the world either couldn’t go to their favourite restaurant due to public health restrictions or they prefered to avoid going outside altogether. This shift in behaviour translated into material revenue gains for food delivery companies.

Link to source: Marketwatch

Take DoorDash and Uber Eats. DoorDash’s revenues in fourth quarter of 2020 were up 226% to reach $970 million, Uber Eats’ revenues were up in a similar fashion by 224% to reach $1.4 billion.

Despite the growth these companies experienced they are still struggling to find a sustainable business model. Uber Eats has never been profitable. Similarly DoorDash has never generated a profit with the exception of the second quarter of 2020 where it made a profit of $23 million. "It took a global pandemic to drive the firm's one quarter (ended June 30, 2020) of GAAP profitability. The firm has not been profitable since, and we think it may never be," said David Trainer, the CEO and founder of New Constructs speaking about DoorDash.

With public outcry that food delivery companies prey on small businesses by charging them fees so high that restaurants often lose money on each order how can food delivery companies be so unprofitable? One of the primary reasons is customer acquisition costs.

Food delivery companies largely sell an undifferentiated service. Have you ever checked the price of a meal you want to buy on both Uber Eats and DoorDash to see which one is cheaper? Once you realize Uber Eats has the better deal there is no compelling reason for you to order from DoorDash. That’s why you often see promotions from these companies either for lower delivery fees or for a certain percentage off the cost of your order.

For consumers these deals are very beneficial but for food delivery companies it puts them further in the red. In the third quarter of 2022 DoorDash paid $446 million in marketing expenses or 35% of revenues. A healthier rate of marketing spend would be around 10% of sales. In 2019 DoorDash spent 101% of its revenues on marketing in the first quarter a few months before it passed Grubhub in market share. "We use the vast majority of our sales and marketing and promotions spend to bring new consumers to DoorDash and to encourage their repeat use of our platform," DoorDash wrote in its IPO filing.

Even bottled water is more differentiated than food delivery services. The only real differentiator is the restaurants on each platform but over time many restaurants have simply listed their menus on all of the major platforms. The other major cost food delivery companies incur is labour. Food delivery companies have lobbied governments in several jurisdictions to let them continue to classify their drivers as independent contractors instead of employees. By doing this food delivery companies do not have to pay for healthcare or paid sick leave.

Even without these costs food delivery companies still have to pay drivers to deliver food. But the amount drivers are paid is often less than the delivery fees paid by consumers. “Cumulative payments to drivers for…deliveries…historically have exceeded the cumulative delivery fees paid by consumers,” Uber wrote in its third quarter 2020 earnings release. This is largely the result of charging consumers low fees for delivery. If you go on the Uber Eats app right now you will see many cases were the delivery fee is 99 cents or $1.99. Low fees are just another tactic to gain market share.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

The only likely path to profitability for food delivery companies is through market consolidation. If there are fewer players in the market then there is less of an incentive to engage in cutthroat pricing tactics. In this scenario it will also be easier to raise prices since customers won’t have many alternatives. “The restaurant industry wants to cap commissions,” said Mark Cohen, director of retail studies at Columbia Business School. “The only way to offset this conundrum is to raise the prices of the food. When all is said and done, the consumer is going to pay the price.” This has played out in Jersey City where Uber added a surcharge of $3.00 on all orders after the city put a 10% cap on delivery fees. Uber has since removed the surcharge but that doesn’t mean we shouldn’t expect higher prices in the future.

But raising prices may not be enough. In a particularly revealing shareholder’s letter in October of 2019 GrubHub wrote: “we didn’t then, and still don't believe now, that a company can generate significant profits on just the logistics component of the business. It is a commodity and there are significant variable costs that are hard to leverage even with technology and scale.” “Bottom line is that you need to pay someone enough money to drive to the restaurant, pick up food and drive it to a diner. That takes time and drivers need to be appropriately paid for their time or they will find another opportunity.”

Without venture capital food delivery companies likely would not exist or at least not in their current form. DoorDash raised over a $1 billion in capital before its IPO during which it raised another $3.4 billion. “Third-party delivery platforms, as they’ve been built, just seem like the wrong model, but instead of testing, failing, and evolving, they’ve been subsidized into market dominance,” says Ranjan Roy a content strategist. “The more I learn about food delivery platforms, as they exist today, I wonder if we’ve managed to watch an entire industry evolve artificially and incorrectly.”

In addition to potential price increases in the future, food delivery companies are hoping to improve their economics with loyalty programs. DoorDash launched DashPass its loyalty program in 2018. For a $9.99 monthly fee, DoorDash subscribers receive unlimited food deliveries from participating restaurants. More than 10 million customers have signed up for DashPass. “With DashPass, they know that every time they open the DoorDash app, they’re going to get a zero-dollar delivery,” says Jack Ruth, former director & general manager of DashPash at DoorDash.

Customers subscribed to DashPass tend to buy food from a wider variety of restaurants, which increases the stickiness of the program which in turn makes those customers more profitable in the long run. If you are subscribed to a loyalty program you are less likely to take your money elsewhere since you have already made an investment in one provider. Amazon knows how well programs like these can work. “So if you look at total revenue per MAU for a DashPass user versus somebody that doesn't use DashPass, the total dollars of revenue or total dollars of gross profit for a DashPass consumer tends to be higher than they do for non-DashPass consumers,” says DoorDash CFO Prabir Adarkar.

DoorDash is also focusing on building websites for restaurants that allow for online ordering as part of its path to profitability. “In cases where merchants don't have an online ordering solution, they can use DoorDash Storefront, which enables them to participate in e-commerce and gives them a product that's seamlessly tied to their back-of-house systems. Over time, we will have to build even more products and services to enable merchants to run their digital business as effectively as we operate our marketplace,” says DoorDash’s CEO Tony Xu.

You may also like:

eCommerce and its Profitability Issue. Why its So Hard to Make Money

Best Buy’s eCommerce Strategy, What You Need to Know

5 Reasons Walmart’s eCommerce Strategy is Winning

8 Reasons Why Blockbuster Failed & Filed for Bankruptcy

10 of the Best Augmented Reality (AR) Shopping Apps to Try Today