Today’s blog is adapted from an earlier piece posted on our the blog by partner, Ebeltoft Group, with the title “Is it a V or W-Shaped Recovery?” Click here to read the original post.

It appeared in June that retail has made a remarkable V-shaped recovery – but the results released this month are suggesting that it isn’t as simple as that.

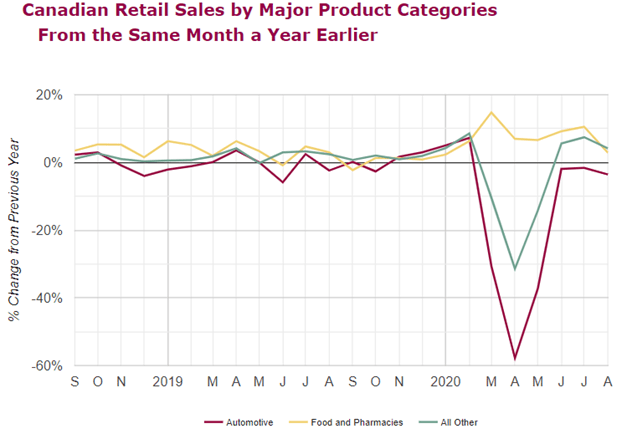

It can easily be said that the 2020 pandemic shutdown impacted retail on an unprecedented level, with some categories reporting a negative growth of nearly -90%. As can be expected, the graph below illustrates that major product category results follow closely with store closure rates, where April was the first and only full month of full shutdown across Canada and some of the United States. Canadian retail recovered at a rate almost as fast as it dropped but has since slowed down without quite reaching pre-pandemic levels. This slowdown is mirrored in the U.S., where more recent numbers are available.

Not Reduced Spending, Just Spending Differently

Unlike other depressions, consumers did have money to spend, just nowhere to spend it. As a result, when stores reopened, pent-up demand drove rapid recovery. Moreover, Canadians had a need for different assortment of products to suit a new assortment of needs. Many Canadians spent more time at home this summer than they have in years gone by, and with no school or summer camp, so have their kids. The need for exercise equipment when gyms were closed, entertainment and hobbies for their kids, and home goods to update the spaces they are suddenly spending so much time in all drove major increases.

The reduced spend at restaurants is also illustrated in the chart, as Canadians spent 18% less at restaurants during this period compared to the same period last year. Not only does this category face unique challenges in terms of customer safety, restaurants would not have benefitted from any pent-up demand.

Government assistance has been credited as a major driver for increased spend, but the J.C. Williams Group Canadian E-tail Report (Summer 2020 edition) found that just a quarter of Canadians received government assistance as a result of COVID-19, compared to half of all Canadians experiencing some kind of income loss or disruption. Either way, Canadians haven’t reduced spending – just distributed it differently.

Omnichannel Integration

Certain categories, most notably Food and Pharmacies, did not experience a sales decline. These categories experienced limited shutdowns and are essential services that shoppers had no choice but to visit, making them the perfect test subject for innovation as the rest of retail looked on. Food and Grocery in particular saw challenges that other categories would later face on a rapid timescale: product touchpoints, supply chain shortages, and a change in standard tooling. The most successful solution was the buy online, pick-up in-store (BOPIS) model, which isn’t new, but saw a huge surge in use. J.C. Williams Group’s Canadian Etail Report (Summer 2020 edition) revealed that BOPIS grew by 200% in Food and Grocery, compared to a 36% increase across all categories. In the U.S., Walmart and Target both saw huge growth in their curbside pickup programs, with the latter reporting a 700% increase for Q2. For many retailers that had to shut down their stores, BOPIS or online webstores were their only source of revenue for the duration of the shutdown. Even afterwards, having these systems established will put them ahead of the game.

Keeping It Local

The weakest businesses in recessions are the small ones. Many of these, such as independent gyms, apparel, gift shops, and especially restaurants rely on the social aspect of retail to attract customers, something that just isn’t possible during a pandemic. Furthermore, experiential models such as local coffee shops or bars rely on in-person visits, something that just can’t be purchased online. However, with consumers working from home and the perceived crowds of the city, spending is becoming decentralized out of city centres. This combined with the already-established movement to buy local has supported the most vulnerable members of retail. The Canadian E-tail Report (Summer 2020 edition) highlights that almost one quarter of Canadians changed their shopping habits to actively buy locally sourced products. Delivery programs such as UberEATS or Toronto’s new service Foodzinga (which promises to keep its commission rate low in response to restaurant backlash on other services) also help out small restaurants who might not have the capital to launch a delivery program of their own.

Next Steps – Holiday 2020

Amazon is, as always, ahead of the game, having positioned its rescheduled Prime Day perfectly for the anticipated early holiday shopping with the slogan “Save now. Wrap later.” Despite the reschedule and dramatically reduced promotion of the event (e.g., no Prime Day concert, and confirmation of the event just weeks ahead of it), Prime Day 2020 again smashed records, and counter-sales on non-Amazon retail sites saw a 76% increase in the U.S. and 69% globally compared to the first day of Prime Day in 2019 (Digital Commerce 360). Customers are already starting to buy for holiday 2020.

Last year, Canadians spent almost a third of their gift expenditure online. But in 2020, this could be as high as two thirds or more. Retailers and mall operators alike have a unique responsibility to keep customers safe during this potential second wave, starting by taking a very close look at customer flow this holiday season.

* Canadian Etail Report – J.C. Williams Group has been conducting a semi-annual survey of 5,000 Canadian on their ecommerce shopping habits since 2013.

Leave a Reply