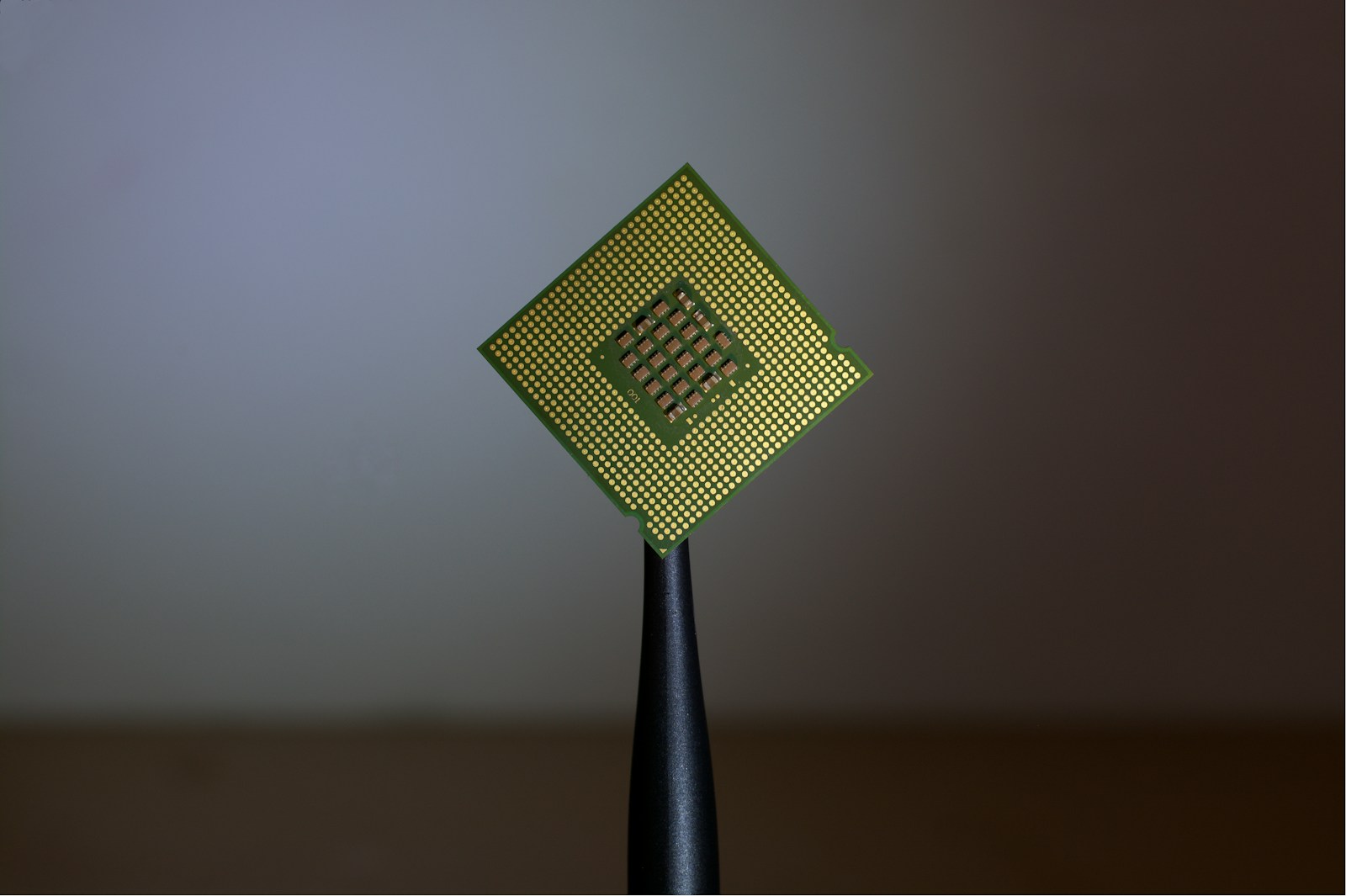

Photo by Brian Kostiuk on Unsplash

Arm Hits a Home Run With Impressive Third-Quarter Earnings

February 8, 2024

The tech company Arm announced its third-quarter earnings that exceeded expectations, promising a profitable forecast for the next quarter. This revelation immediately provoked a surge in Arm’s shares, which skyrocketed up to 41% in extended trading.

The company’s earnings for the quarter ending in December were not just a win, but a grand slam. The earnings per share were up to 29 cents, overtaking the expected 25 cents. Additionally, Arm’s revenue reached $824 million, soaring past the anticipated $761 million.

Arm, celebrated worldwide for its chip design technology found in almost every smartphone and many PCs, isn’t resting on its laurels. The company foresees earnings per share between 28 and 32 cents for the upcoming fiscal fourth quarter, with sales between $850 million and $900 million. Analysts project lower earnings — only 21 cents per share, on sales of $780 million.

The third quarter turned out to be a golden period for Arm. It generated a net income of $87 million or 8 cents per share. The company also experienced a significant boost in total revenue, which shot up by 14% from the previous year.

Arm earns its profits primarily through royalties, paid by companies for the right to produce Arm-compatible chips. This payment is typically a small fraction of the final chip price.

The company’s clients had a busy period in the September quarter, shipping a whopping 7.7 billion Arm chips. This massive output undoubtedly contributed to the surge in stock prices, peaking at $108.89 after-hours. However, it closed on Wednesday at $77.01.

Revenue from royalties enjoyed an 11% annual increase, reaching $470 million. Arm attributes this leap to a rejuvenation of the smartphone market and augmented sales to automotive and cloud companies. The company, confident of its growth trajectory, expects this trend to continue.

In recent times, Arm has prioritized its licensing business, offering sophisticated designs that semiconductor companies can incorporate into their chips. This strategy is not only lucrative for Arm but also saves chip makers the hassle of starting from scratch.

The company’s license revenue experienced a year-over-year increase of 18%, reaching $354 million. Arm states that more firms are opting to license its CPU designs for artificial intelligence operations, resulting in higher licensing fees for advanced designs.

Arm, established in 1990 to create technology for low-power chips, took the tech world by storm when the Apple iPhone and Android devices standardized on Arm-based chips. Formerly owned by SoftBank, Arm went public in September. Today, industry leaders like Apple, Google, Microsoft, and Nvidia utilize Arm’s technology, solidifying its firm footing in the tech industry.

Recent News

Top Deals for National Hamburger Day 2024

National Hamburger Day 2024 is just around the corner, falling on Tuesday, May 28.

Bass Pro Shops CEO Focuses on Affordability Amid Inflation

In response to the persistent inflation affecting the economy, Johnny Morris, the founder and CEO of Bass Pro Shops, has reaffirmed the brand’s commitment to affordability. With inflation currently at 3.4%, above the Federal Reserve’s 2% target, Morris acknowledged the reality of rising costs and emphasized that the hunting, fishing, and outdoor sporting brand will maintain its focus on delivering value to its customers.

European Central Bank Set To Cut Interest Rates Next Week

The European Central Bank (ECB) is poised to reduce interest rates in its upcoming meeting, marking a significant shift in monetary policy aimed at addressing the current economic landscape.

China Is Spending $47.5 Billion for Chip Industry

China is significantly bolstering its semiconductor industry with a historic investment of $47.5 billion, reflecting its strategic push to become a global leader in advanced technology.